Instantaneous Momentum

Market-Neutral

Survivorship-Bias Free

Single-Factor

Top 40 Market Cap

Tier 2

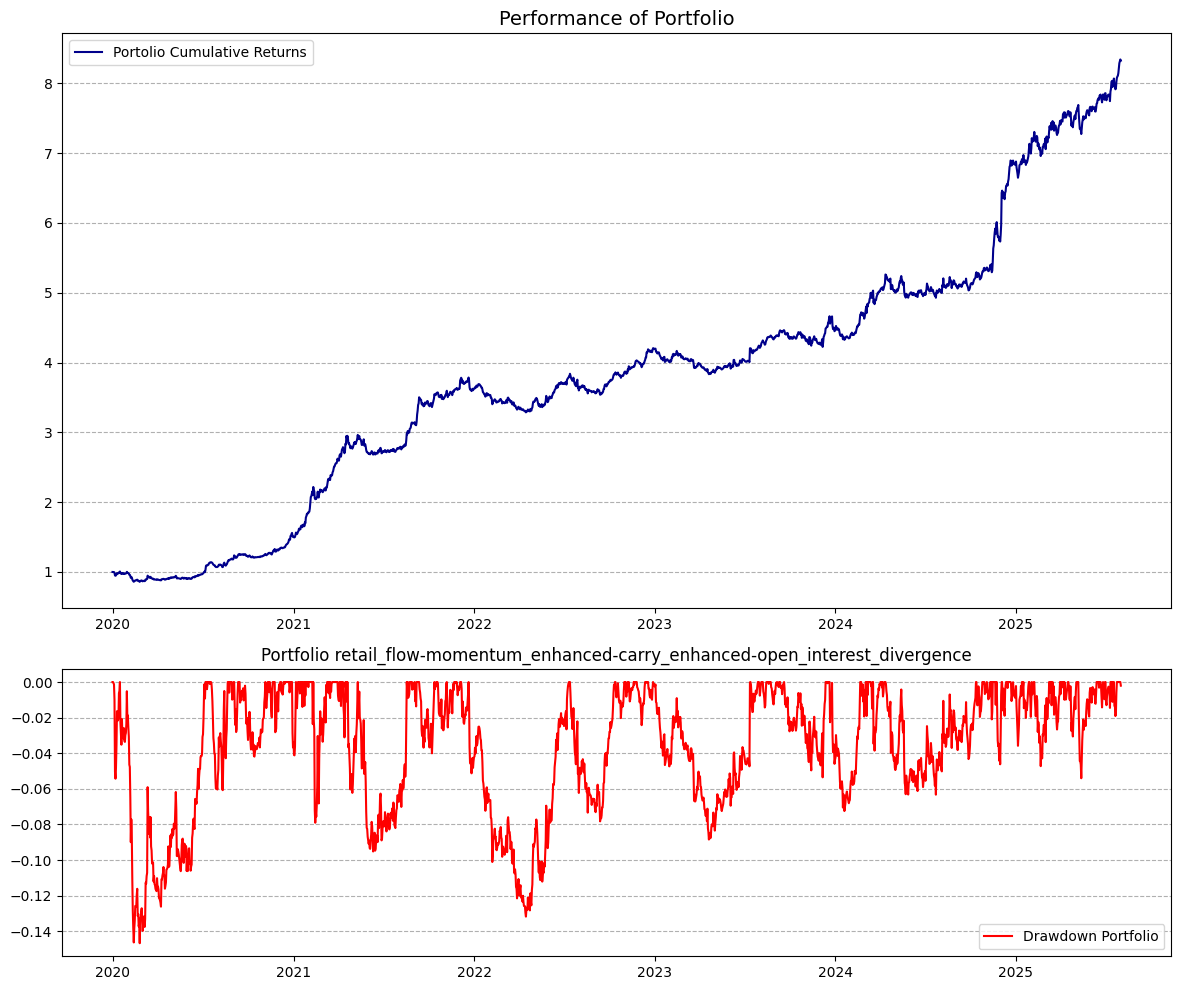

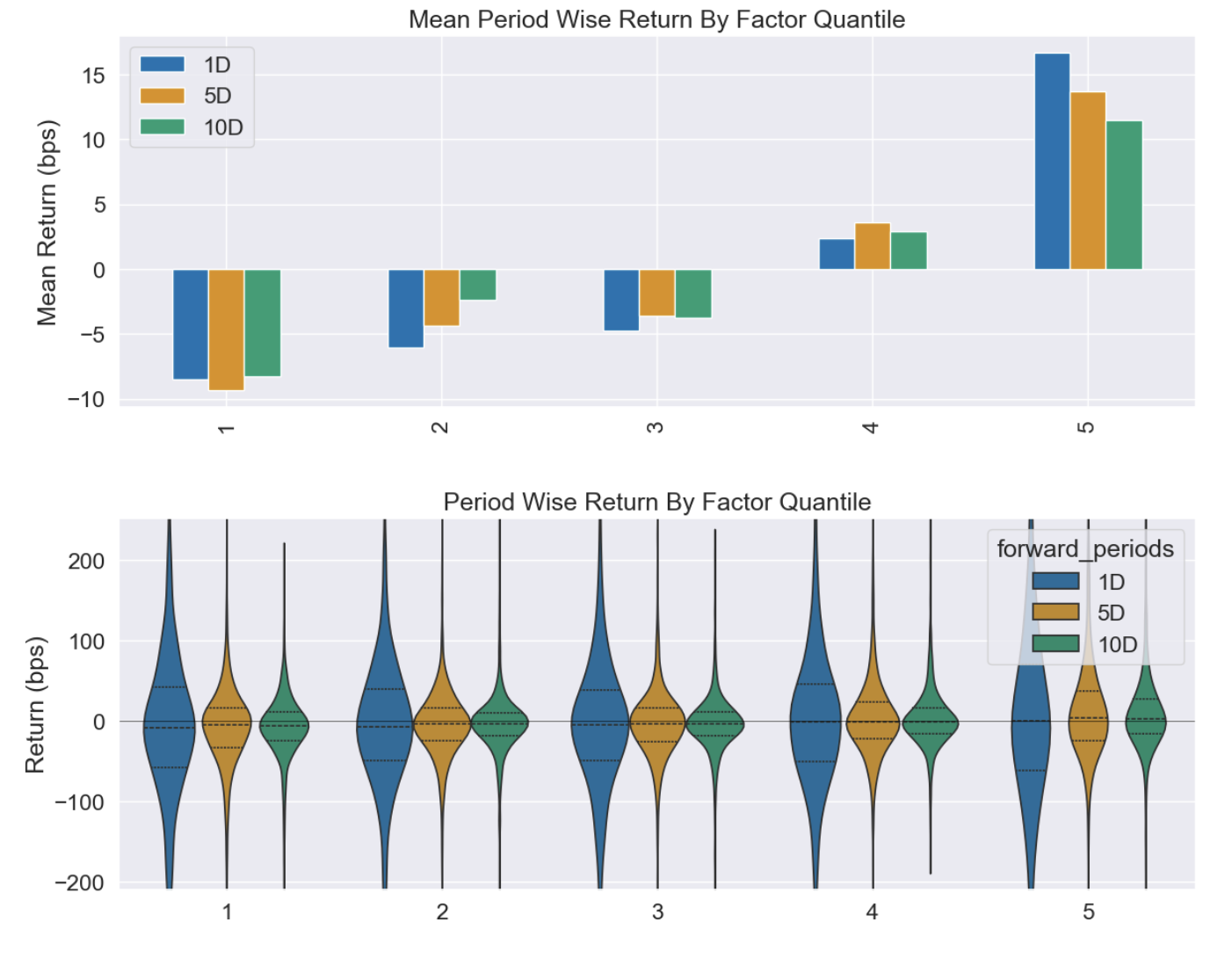

The factor capitalizes on the tendency of assets with higher instantaneous momentum to outperform assets with lower instantaneous momentum.

Its universe consists of the most liquid and actively traded assets, identified on rolling basis - various techniques employed to keep it both stable and relevant, as well as survivorship-bias free.

To balance each asset's risk contribution, positions are scaled according to the inverse of their rolling volatility.

The portfolio is rebalanced daily, weights are calculated at 23:55 and 00:15 UTC.

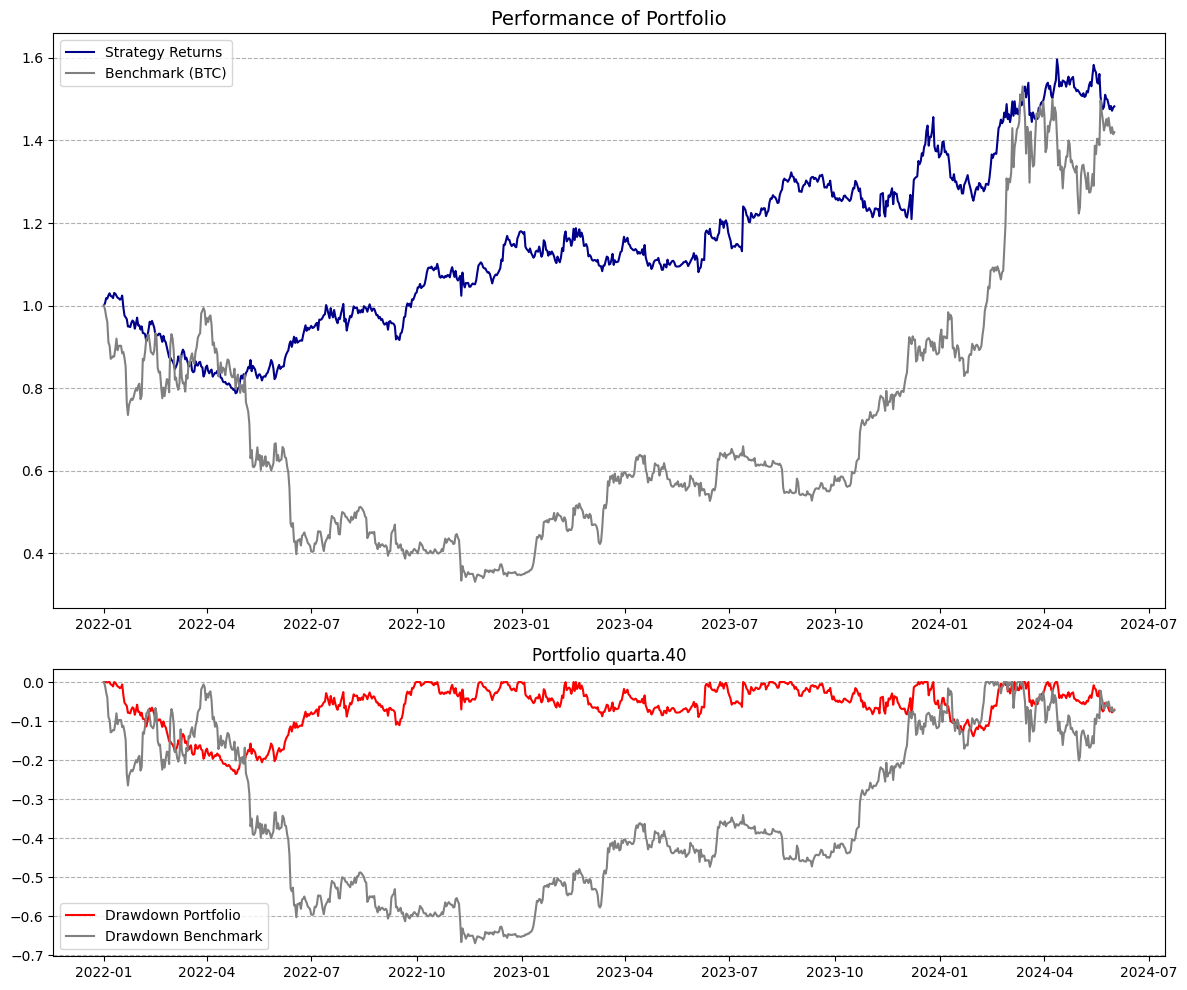

| Benchmark (BTC) | Portfolio | |

|---|---|---|

0.99 | 1.75 | |

51.4% | 75% | |

0.00 | 0.61 | |

1.00 | 0.02 | |

-76.6% | -41.7% | |

60.8% | 35.7% | |

0% | 63.1% | |

100% | 5.4% | |

100% | 201.1% |

Sharpe Ratio

Rolling 12 MonthsBeta

Rolling 12 Months - Benchmark: BTCNet Exposure of Portfolio

Portfolio Variants

Current Weights

1/21/2026, 2:05:39 PM (UTC)

The portfolio is designed to be market-neutral on a volatilty-adjusted basis, therefore it may have net directional exposure on any given day. The weighting mechanism ensures that volatility-weighted directional exposure is negligible on the portfolio level.

| Ticker | Name | Arrival Price | Weight | Date |

|---|---|---|---|---|

| BTC | Bitcoin | 88700.503 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ETH | Ethereum | 2929.367 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| SOL | Solana | 127.116 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| XRP | Ripple | 1.894 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| DOGE | Dogecoin | 0.123 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| SUI | Sui | 1.473 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| BNB | Binance Coin | 873.716 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ADA | Cardano | 0.353 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| TRUMP | TRUMP | 4.858 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| LTC | Litecoin | 67.619 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| LINK | Chainlink | 12.148 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ONDO | ONDO | 0.328 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| AVAX | Avalanche | 12.032 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| DOT | Polkadot | 1.912 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| BCH | Bitcoin Cash | 584.937 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ENA | ENA | 0.176 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| HBAR | Hedera | 0.107 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| TRX | TRON | 0.295 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| AAVE | Aave | 154.539 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| FIL | Filecoin | 1.326 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| TAO | Bittensor | 230.088 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| WLD | WLD | 0.473 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| NEAR | NEAR Protocol | 1.505 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| UNI | Uniswap | 4.826 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| APT | Aptos | 1.549 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| TON | Toncoin | 1.528 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ETC | Ethereum Classic | 11.507 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| XLM | Stellar | 0.209 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| OP | OP | 0.305 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ARB | Arbitrum | 0.181 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| SEI | SEI | 0.106 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ATOM | ATOM | 2.337 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| POL | Polygon | 0.132 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| SHIB | SHIB | 0.000007806834825442739 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ALGO | Algorand | 0.115 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| HYPE | HYPE | 20.764 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| CAKE | CAKE | 1.903 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ZEC | ZEC | 358.339 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| WLFI | WLFI | 0.169 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| ASTER | ASTER | 0.595 USD | 0.00% | 2026-01-21T14:05:39.146509+00:00 |

| 0.00% | ||||

Properties

Frequently Asked Questions

What is the construction methodology of the model portfolio on display? How do I replicate it?

The portfolio is constructed by applying cross-sectional binning - quantiles. This ensures that the weights are calculated in proportion to the strength of the factor. The assets are then weighted according to the inverse of their rolling volatility, to mitigate the impact of widely different volatilities of digital assets. We provide a replication notebook in the "Resources" section that will produce a very similar portfolio than what's shown on the site.

Is the raw factor data available?

Yes, we serve the raw factor data via the "portfolio/factors" endpoint, please see the API Docs for more information.

What is smoothing? Some factors have by default setting (eg. 10 Day Moving Average) applied. Why is that?

Some of the cross-sectional factors have very high turnover, and despite being highly predictive, the alpha does not survive transaction costs. Smoothing (applying a simple moving average) is a way to reduce the turnover and the impact of transaction costs.

What is the universe of assets? How is it determined? Is it survivorship-bias free?

The universe of assets (there are multiple variants, for example, top 20, 30, 40 market cap digital assets) is the most liquid and actively traded assets, identified on rolling basis - various techniques (volume, open interest, volatility filters) are employed to keep it both stable and relevant. The universe is survivorship-bias free.

What is the rebalancing frequency?

The portfolio is rebalanced daily, weights are calculated at 23:55 and 00:15 UTC, and available point-in-time.

What are the transaction cost / slippage assumptions?

There are 0.05% transaction costs applied on each position adjustment. This is a parameter that can be adjusted in the backtest settings. Slippage, spread is not considered in the simplistic backtest that's on our site. We encourage using an independent backtesting infrastructure to validate performance.

When have been the factors developed? Is there an out-of-sample period?

Our cutoff date for our research process is 2024-01-01, we consider any data onwards as out-of-sample. Many factors have been traded live in some form from 2025-01-01.

Some of the factors look great! Should I pick an individual factor and start trading it?

We recommend using a portfolio of factors to maximize risk-adjusted returns. Alpha from individual factors is simply not consistent enough, and even running a simple arithmetic average of 3-5 relatively orthogonal factors will produce superior results.

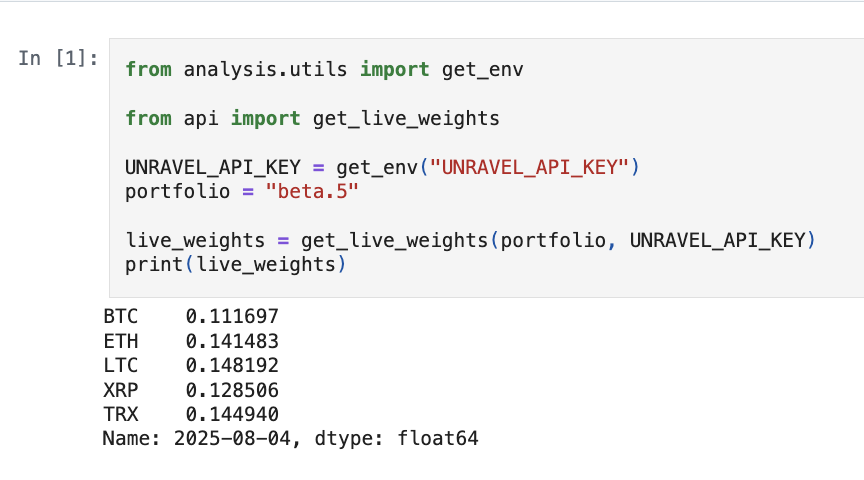

Replication & API

Live Weights

Get live weights with the code provided below.