Financial Science Meets Digital Assets

Cutting-Edge, Market-Neutral Multi-Factor Portfolios for Crypto

Accelerate Research to Deployment

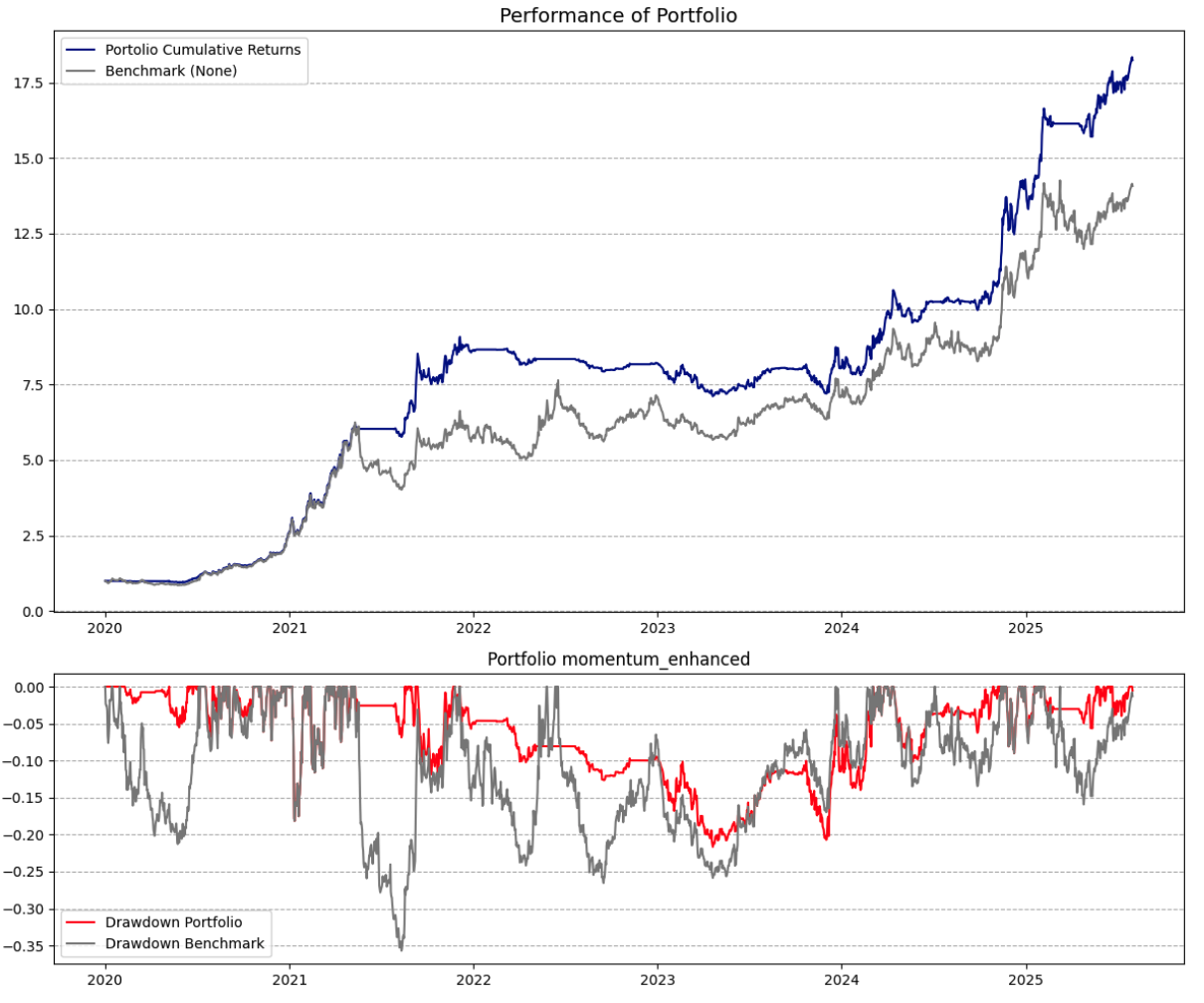

Market-Neutral, Multi-Factor Portfolios

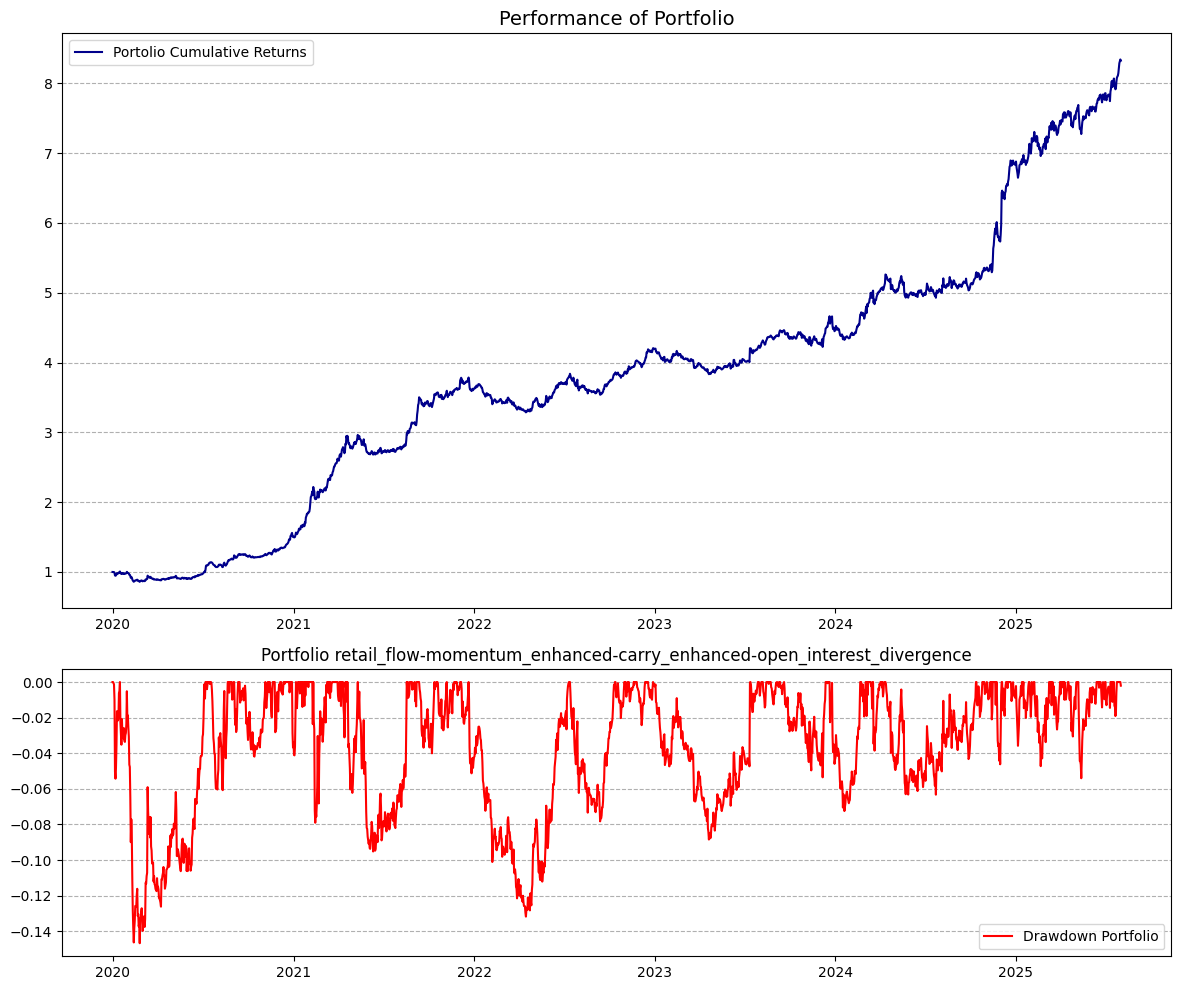

Institutional-grade, high-performance Factor Portfolios

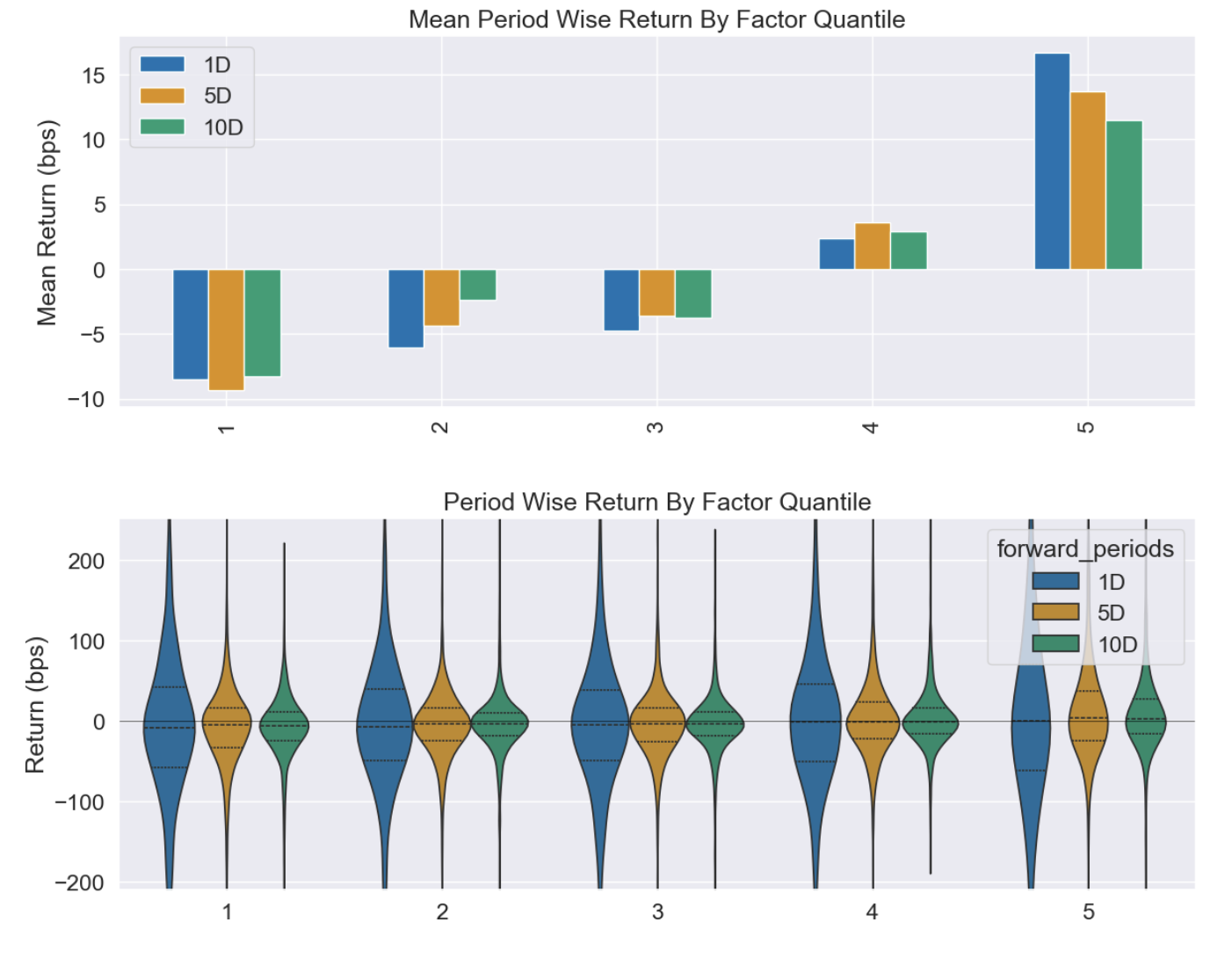

Traditional and Proprietary Factors

Extensive collection of cross-sectional exogenous alpha & factor risk overlays.

Unique Datasets & Alpha Sources

Liquidity, Orderbook-derived, Flow, On-Chain & Sentiment factors.

Endorsed by

Portfolio Highlights

Access Historical Data or Trial Live Data

Explore Notebooks

Get Started

Ready to deploy cross-sectional portfolios?

Schedule a consultation with our team to discuss your specific needs and how our institutional API can give you an edge.