This month we're excited to release Risk Overlays & Regimes, add uptime monitoring, and share updates on what's ahead.

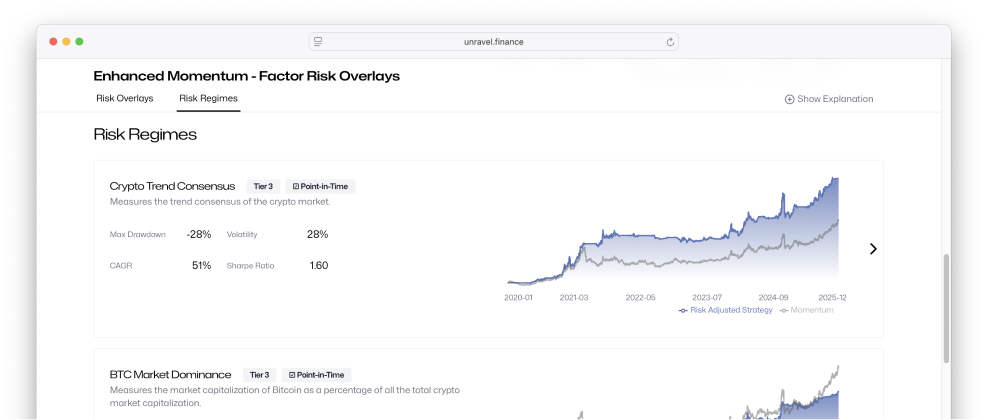

Risk Overlays & Regimes

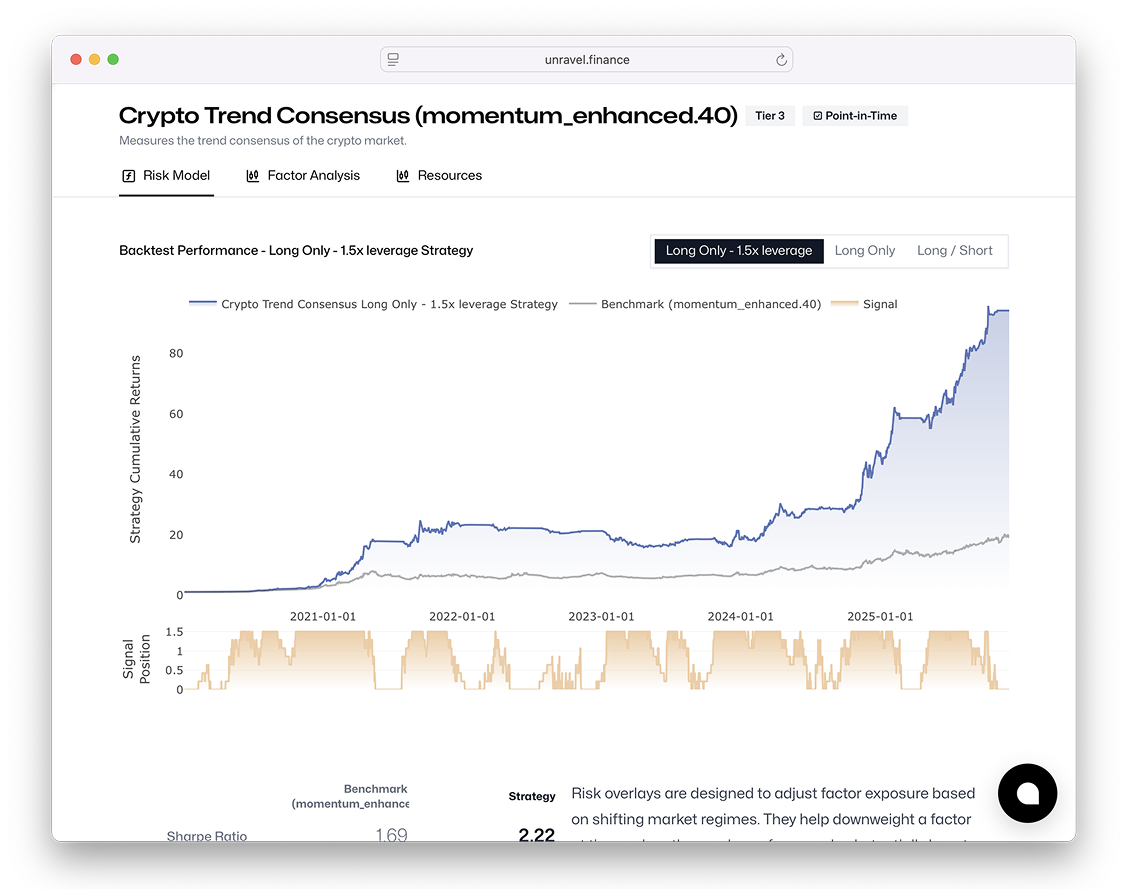

Risk Overlays are out of preview and ready to use. They adjust factor exposures based on shifting market regimes—for example, down-weighting Enhanced Momentum when Crypto Trend Consensus turns negative—and can substantially improve risk-adjusted returns. They're available for Prime members. There are two types of "risk overlays":

- Factor Risk Overlays: based on the factor's own past performance (endogenous)

- Risk Regimes: based on overall crypto market performance and state (exogenous), metrics include market-wide funding rates, etc..

Momentum enhanced with risk regime overlay added, view here. We've also added a new notebook in Resources that lets you recreate an adaptive version of Momentum Enhanced.

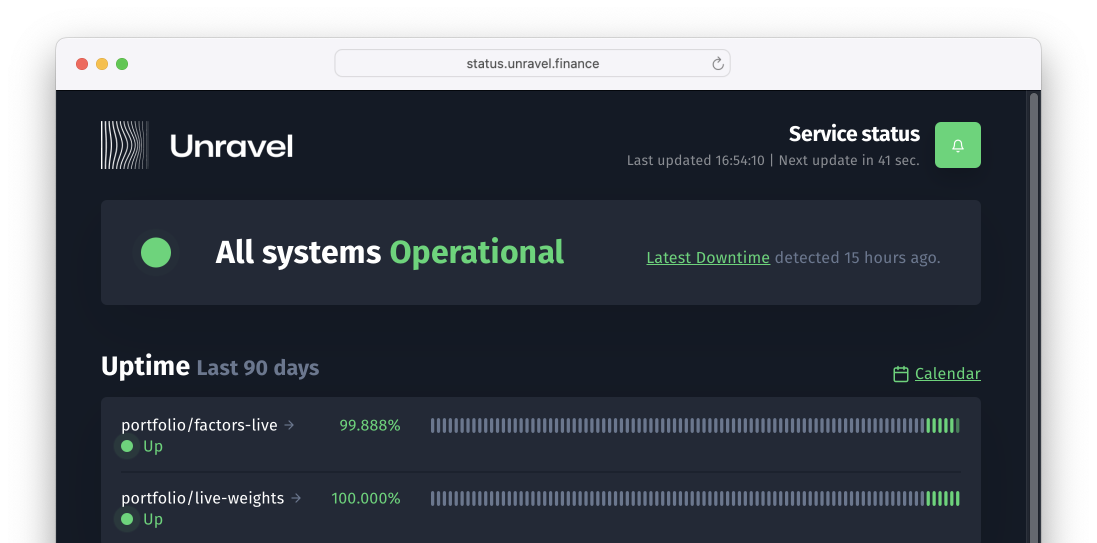

API Uptime Monitoring

We've integrated externally facing uptime monitoring so you can quickly check whether an issue is on our end. Find the status page status page here.

Removing deprecated "Directional Strategies"

Next week, we'll remove the deprecated "normalized series" endpoint. We're working on bringing back the data in a new, more appropriate form - see below.

Deprecating "Carry" and "Quarta"

Spectra effectively replaces Quarta with a more diversified multi-factor portfolio, accessible to Prime members. We recommend switching over, officially.

New Data Offering (Coming Early Next Year)

We are building low-latency infrastructure to serve high-quality, point-in-time market data, standard and unique metrics with full exchange coverage. If you'd like to receive updates or share input on what data would be most valuable to you, let us know here: Sign up to receive updates"

Keep tuned for further updates!

The Unravel Team